riverside county tax collector mobile home

Riverside County Auditor-Controllers Office. Riverside County is home to several museums featuring exhibits in art photography.

Career Opportunities Career Opportunities

The balance is distributed among agencies that provide public safety fire protection public health the construction and maintenance of roads bridges and other public services dedicated to preserve and improve our countys infrastructure.

. Watch Board Meetings live from your computer or mobile device. Fill out the form below to check the status of your clearance certificate if you have previously made a request. Although the Assessors office does not assess manufacturedmobile homes the miscellaneous structures such as carports patio covers additions concrete pads and utility hookups are assessed by the Assessors.

Or take a history tour with our award-winning Historic Riverside County mobile app featuring more than 120 historic sites. If a mobilehome was purchased new after June 30 1980 or if the payment of annual license fee renewals on a mobilehome are delinquent more than 120 days except delinquencies which begin after May 31 1984 a Tax Clearance Certificate is required to be issued by the County Tax Collector prior to transfer of title through. Riverside county tax collector mobile home Sunday April 24 2022 Edit.

The Assessor must complete an assessment roll showing the assessed values for all property and maintain records of the above. Even if a park model or licensed manufacturedmobile home itself is not assessed any existing or added items such as awnings additions stairs decking skirting concreteasphalt slabs are taxable will be part of the structural component of the taxes. Receives the extended assessment roll prints and mails the property tax bills to the name and address of record.

The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans. TREASURER AND TAX COLLECTOR Donna Riley Treasurer and Tax Collector PO Box 859 Modesto CA 95353 1010 10th Street Ste 2500 Modesto CA 95354 Phone. Following receipt of this information the Tax Collector performs a search of the tax rolls to verify that mobilehome assessments exist for each applicable tax year following the date the mobilehome was originally entered on the Countys tax rolls.

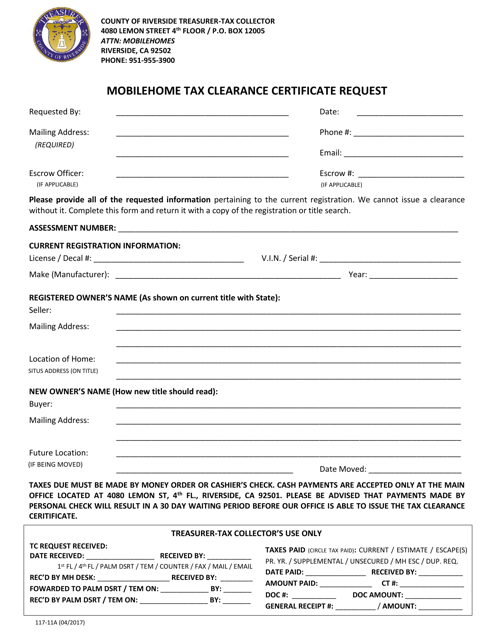

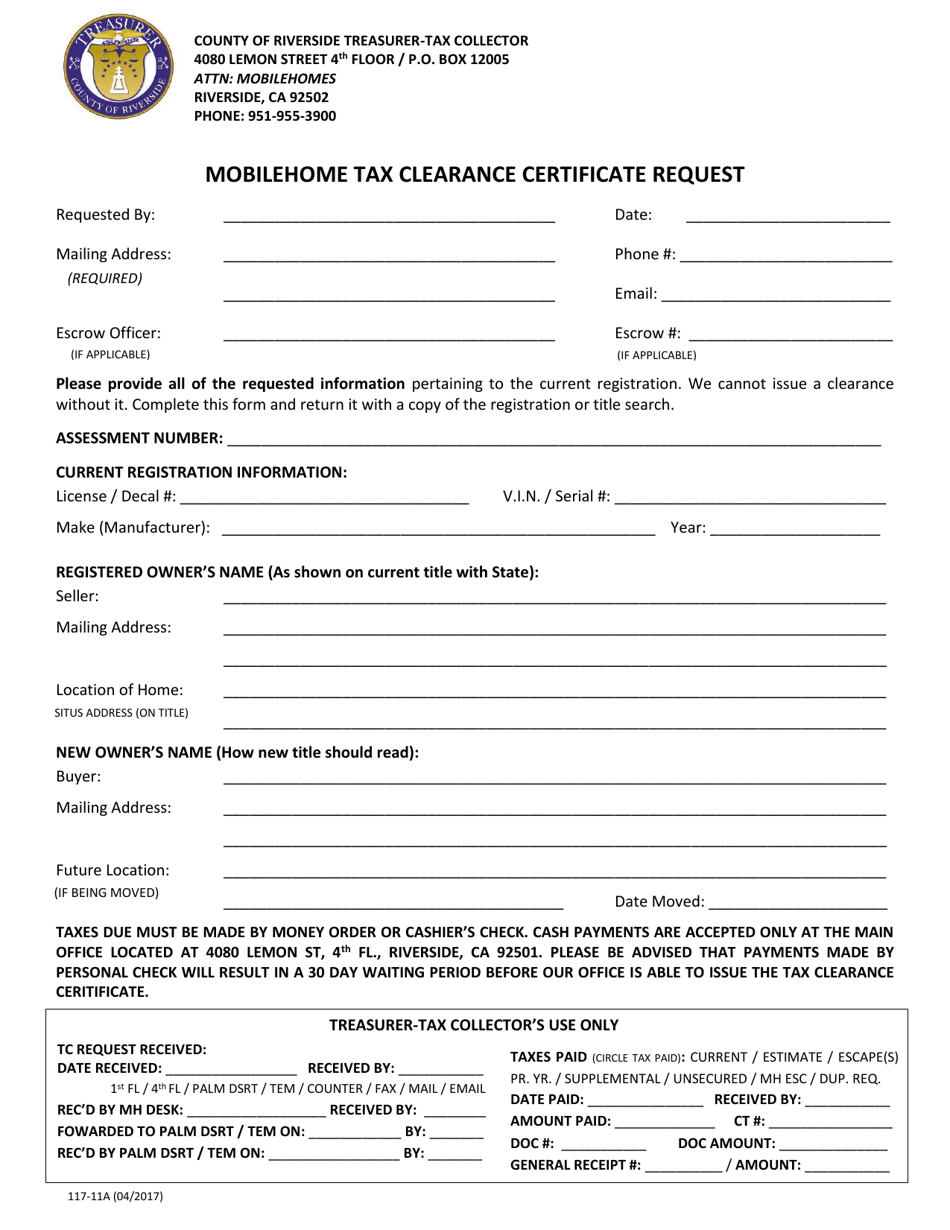

Welcome to the Riverside County Property Tax Portal. Please be advised that if for any reason you are unable to make your tax payment in an automated fashion over the phone or web you are still responsible to make payment timely in order to avoid. Mobilehome Tax Clearance Certificate Request.

The deadline to make the first installment of secured annual property taxes is Dec. Home CA Riverside County Parish Government. You will probably not find this information to be of interest.

MR properties are lots that have licensed manufacturedmobile homes pre-1980 with tags that are assessed by Housing and Community Development HCD. Location of Mobile Home On the Tax Roll. We empower our workforce to excel.

The Assessor does not set tax amounts or collect taxes. Box 12005 Riverside CA 92502-2205. OFFICE OF THE TREASURER-TAX COLLECTOR RIVERSIDE COUNTY CALIFORNIA Home Search Last Search Results.

County Tax Collector in Riverside CA. If you want a copy of the tax book you actually need to pay 35 and send an official request to the following address. Meet the Tax Collector Meet the Executive Team.

If you call them directly at 951-955-0329 they may be able to give you specific information over the phone. Riverside County Treasurer Attn. They can be reached at 760 237-7808 or 951 782-4431.

If you are not an Escrow company doing this kind of business or doing your own Mobile Home tax certificate. 209 525-4347 APPLICATION FOR MOBILE HOME TAX-CLEARANCE. Florida law does not provide for mobile manufactured home registration renewal notices although the Tax Collector of Indian River County does mail out courtesy renewal notices.

The Assessor must determine a value for all taxable property and apply all legal exemptions and exclusions. We provide exceptional stewardship of public funds. They can be reached at 760 237-7808 or 951 782-4431.

Treasurer-tax collectors use only county of riverside treasurer-tax collector 4080 lemon street 4th floor po. County Parish Government 714 834-4000. The Riverside County Treasurer - Tax Collector is proud to offer online payment services.

Welcome to Riverside County Assessor Online Services. Registrations are renewed annually and expire December 31st. We continually pursue organizational excellence.

Riverside County is home to several museums featuring exhibits in art. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures.

In Mobile County almost 47 of the property taxes collected are for public education. The Department of Housing and Community Development of the State of California records Mobile Home registrationONLY the Department of Housing and Community Development is authorized to transfer title of your mobile homeThe transfer process BEGINS with a Tax Clearance Certificate issued by the local. Senior Tax Worker Program.

These courtesy renewal notices are mailed 4 weeks prior to the month in which the registration expires from data compiled by the. County of Orange Household Hazardous Waste Collection Center. The Treasurer-Tax Collectors Office strongly encourages taxpayers to make payment online.

Important Notice to All Sellers and Buyers of Mobile Homes. Click Here to request a Mobile Home Tax Clearance Certificate. Thomas CFC Pinellas County Tax Collector.

Riverside County Planning Department Frequently Asked Questions. Name A - Z Sponsored Links. We serve our customers respectfully accurately and professionally.

The Treasurers Office collects taxes for real property mobile homes and business personal property. The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300. The Treasurer-Tax Collector collects the taxes and invests the proceeds in the Treasurers Pooled Investment Fund for later distribution by the Auditor-Controller to taxing entities throughout Riverside County.

Programs And Services Environmental Health County Of Riverside

489 Mobile Home Parks Near Riverside County Ca Mhvillage

Meet Your Treasurer Tax Collector

Riverside County Ca Property Tax Search And Records Propertyshark

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

County Ordinance Eases Process For Building Accessory Dwellings For Additional Housing

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

How Changes To California S Property Tax System Could Affect Reassessments Inlandempire Us