retroactive capital gains tax september 2021

With everything else uncertain those who have had or could. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9president.

Richest Americans Want Clarity On Tax Hikes So They Can Avoid Them Bloomberg

Capital gains that are long-term gains and so-called qualified dividends are taxed currently at a maximum rate of 20.

. Call Us Now To Schedule An Appointment. As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate. The Treasury Greenbook is a summary explanation of.

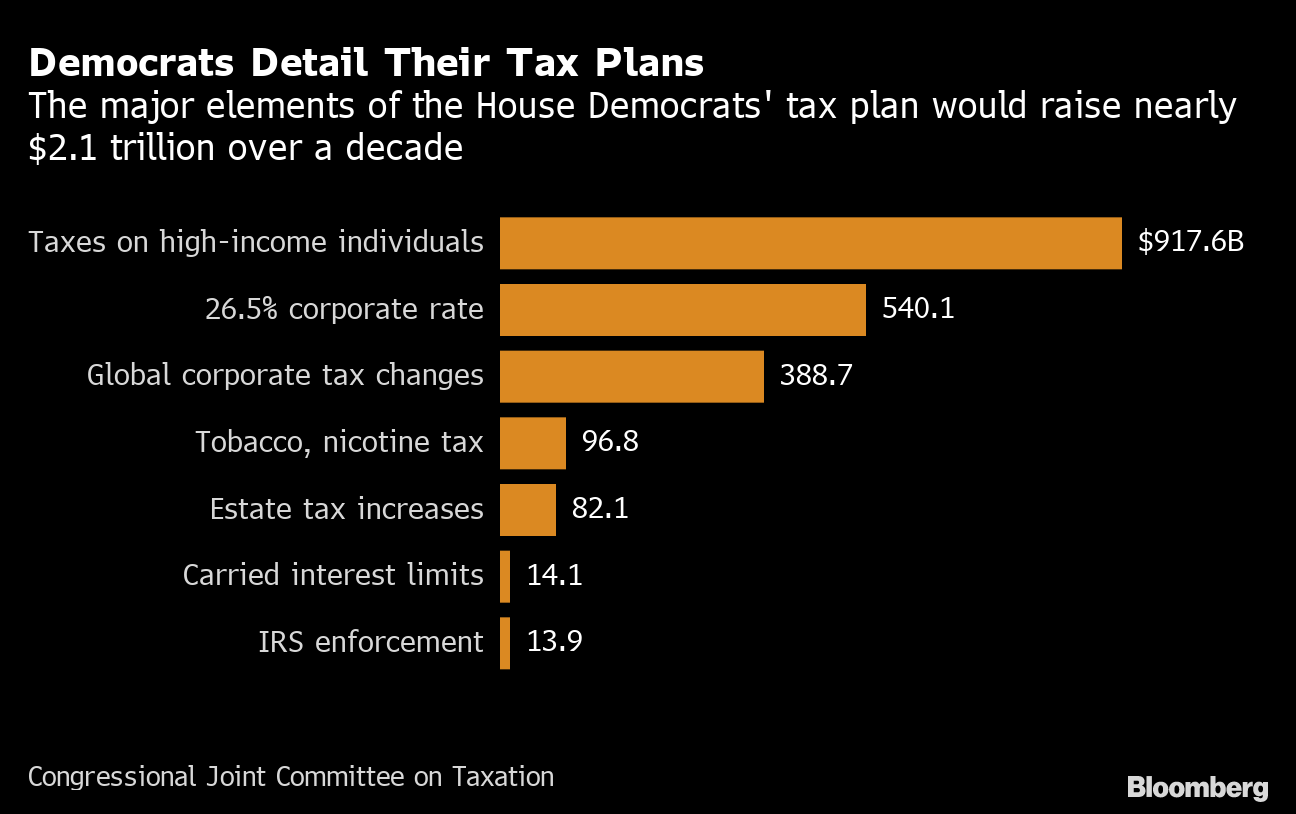

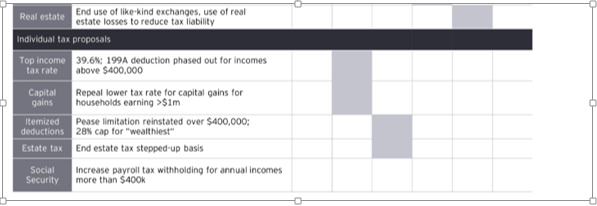

Under the HWM Proposal this rate will increase to. Who would see another 3 tax raise. The individual tax rate could just from 37 to 396 for those making more than 400000 annually.

On The Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be. 7 rows This leads to the question of whether gains from transactions completed in 2021 but prior to such legislative change could be subject to a higher capital gains rate. An exception to this retroactive effective date applies to written binding contracts in effect as of September 12 2021 in the case of the 50 limit on the gain exclusion for.

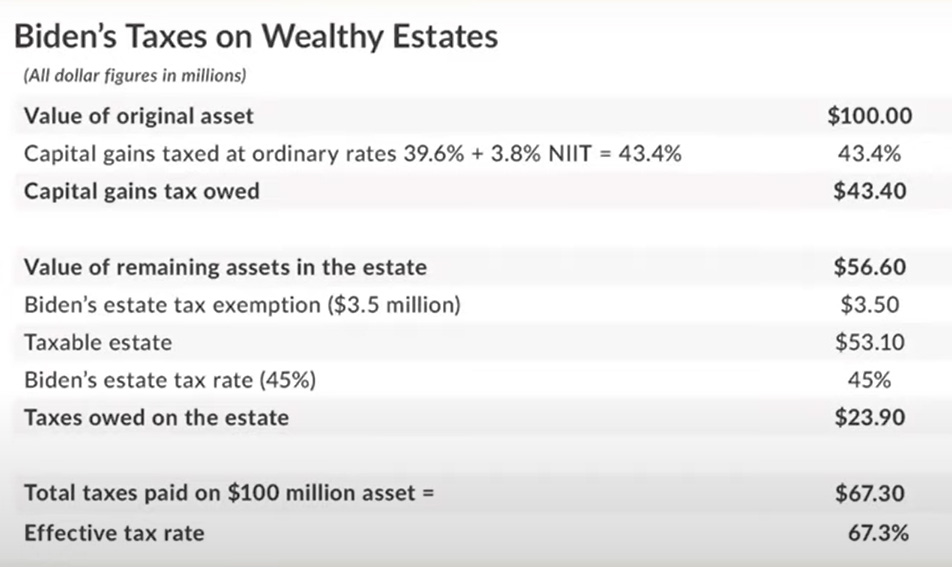

On May 28th 2021 the United States Department of the Treasury published the Greenbook for the Biden Administration Budget Plan. The 20 tax rate on capital gains can raise as high as 318 for. Raising the top capital gains rate for households with more than 1 million.

A Retroactive Capital Gains Tax Increase Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be. Retroactive Capital Gains Tax Hike.

The Presidents proposed 434 capital gain rate is supposed to hit only those earning 1M or more but if you bought a house 30 years ago that is now worth over 1M you. The capital gains tax increase as of September 13 2021 there are no retroactive taxes in the proposal affecting individuals estates or trusts. Some of these provisions if enacted.

I read that it would be unconstitutional and struck down in the courts if Biden attempts to try to make his still-unpassed elimination of long-term capital gains rates. Biden plans to increase. The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38.

As MarketWatch points out the change primarily affects those households with income of 1 million or more. September 07 2021 Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is.

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Year End Tax Planning During Uncertain Times Morningstar

Retroactive Tax Legislation And Gift Planning In 2021 New Jersey Law Journal

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Tax Implications Of Selling Your Business In 2021 Vs 2022

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Capital Gains Tax Hike And More May Come Just After Labor Day

How To Protect Against Biden Tax Plans 2021 Urgent Actions

2022 State Tax Reform State Tax Relief Rebate Checks

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Year End Tax Planning During Uncertain Times Morningstar

Biden S Proposed Retroactive Capital Gains Tax Increase

Tackling State Tax Controversy Tei S Audits And Appeals Seminar September 21 22 2022 Salt Shaker

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Managing Tax Rate Uncertainty Russell Investments

Estate Planning In A Biden Administration Denha Associates Pllc

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)